You may be aware that many lending institutions cater to physicians. Some banks have even created loan products that are offered specifically to medical residents. Most of these products offer 100% financing (no down payment) with no mortgage insurance. If the seller agrees to pay your closing costs, you could literally buy a home without having to bring any money to the table. Every year I research who is offering these products, as they can change from year to year. I have great relationships with these lenders and can connect you to find the best possible deal. I recommend that you contact a lender sooner rather than later, especially if you are still trying to decide if you are going to purchase a home. Please contact me if you would like their information.

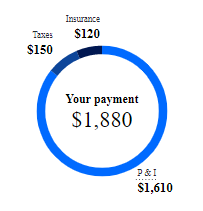

Below I’ve used the purchase price of $300,000 as an example to compare several 100% loan options that may be available to you.

| 5/1 | 7/1 | 30yr | |

| P&I | 1610 | 1633 | 1775 |

| Taxes | 150 | 150 | 150 |

| Insurance | 120 | 120 | 120 |

| TOTAL | $1880 | $1903 | $2045 |

$300,000 example comparison of the 100% loan and 30 year mortgage for the following rates: 5% for a 5/1 ARM with 1% origination; 5.125% for a 7/1 ARM with 1% origination; and 5.875% for a 30-yr fixed rate with 1% origination. ARMs are adjustable rate mortgages–the rate (as well as the P&I) will change after five or seven years. Taxes and insurance amounts above are a generalization. They are determined by property value, area, and insurability and are subject to change over time as well.

Every lender has different products to offer. Note that after an ARM expires, your monthly principal and interest will change based on the adjusted rate. Also keep in mind that 100% financing will not be the best option for everyone. Conventional financing typically requires that you contribute a down payment of some sort, and that helps you build equity from the beginning, which may be something you prefer to do. You may also have a lower principal and interest payment each month because you would be borrowing less to begin with, though a true Conventional loan won’t have any of the features of Resident Financing, like lower interest rates, no mortgage insurance, and of course, no down payment. Many residents decide to pursue the lowest up-front and monthly impact to their budget and if so, the 100% loan is a great option.

|

Using an online mortgage calculator like the one found here will give you general idea of your monthly costs, though property taxes and insurance will be specific to the property. If you need help calculating these, give me a call or I can connect you with a mortgage professional. Discussing your options with a lender is imperative before starting the process. Even if you are considering renting instead of buying, a lender will help you sort through your options.

![]()

Online Mortgage calculator showing the estimated monthly payment for the example above. This is based on 5% on a 100% loan with a 5/1 ARM.

Online Mortgage calculator showing the estimated monthly payment for the example above. This is based on 5% on a 100% loan with a 5/1 ARM.